Generally, mortgage masterminds earn money via the fees that are credited originate a home mortgage as well as the difference between the rates of interest offered to a consumer as well as the premium an additional market will certainly pay for that interest rate. Originate a mortgagemeans to submit an application or paperwork to a mortgage lender or underwriter in an effort to obtain a domestic mortgage ACT, DIRECTLY OR INDIRECTLY, AS A MORTGAGE LOAN MASTERMIND. All fees below are for both mortgage broker licenses and home mortgage lending institution licenses unless otherwise kept in mind. To get a permit to conduct company as a home loan broker or home mortgage lending institution in Massachusetts, you should please the demands of the DOB's regulation. Coverage by a surety bond provided by the mortgage loan producer's employer.

- The Federal Down Payment Insurance Firm is involved in criteria for coming from loans as well.

- G. The executive supervisor might every now and then take such activity as he might consider needed or proper in order to obtain applications for appropriation of funds.

- When an MLO is an employee of an individual loan provider, they can timeshare ruin your credit work exclusively keeping that institution's item offerings.

MLOs obtain a wide array of knowledge on different sorts of mortgage loans and also utilize this information to assist their customers choose the very best finance for their particular scenario. The mortgage producer is the initial business involved in the development of a home loan. Home loan originators consist of retail financial institutions, home mortgage lenders, and mortgage brokers. While financial institutions use their standard resources of moneying to close finances, mortgage lenders typically utilize what is referred to as a storage facility credit line to money finances. A lot http://juliusoqmi360.huicopper.com/home-mortgage-rates-leap-over-4 of financial institutions, as well as almost all mortgage lenders, promptly sell recently stemmed home loans into the second home loan market.

I Job As A Financing Begetter For An Accredited Home Loan Company Do I Need A Bond?

In addition to answering yes to the disclosure question in NMLS, you have to also supply a written declaration discussing why you were incapable to pay your taxes and also a duplicate of the lien as well as your existing payment plan. Along with answering yes to the disclosure concern in NMLS, you must additionally provide a created declaration discussing what the judgment is for as well as why you did not pay it formerly, in addition to a copy of the judgment and your current layaway plan. In addition to addressing yes to the disclosure inquiry in NMLS, you need to also provide a created statement discussing why you applied for personal bankruptcy as well as a copy of your discharge or complete application with all schedules. Car loan producers need to notify the division within one month adhering to any modification to the info consisted of in the application. It is just to alert you that a shortage has actually been put on your certificate.

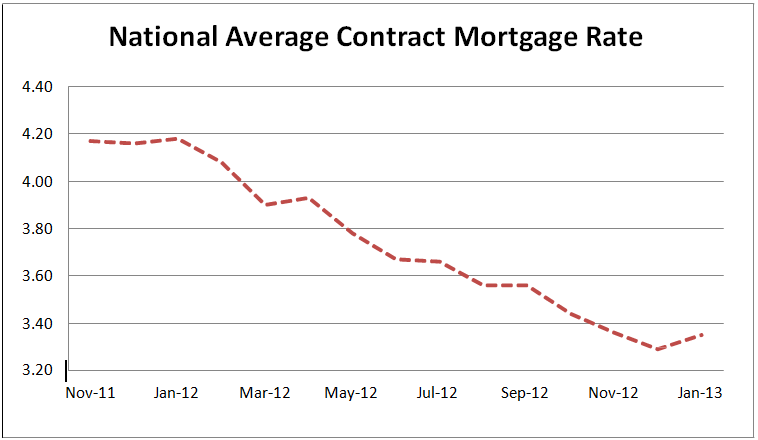

Rates Of Interest

There are several task duties at a home loan company that, in most states, do not call for a certificate. This usually consists of processors, experts, and assistants that are not involved in offering or bargaining fundings. Obtain any kind of payment as a result of a borrower entering into domestic home loan terms.

Debtors are attempting to capitalize on the reduced rates, while lending institutions grapple with the surge in re-finance volumes and also the backlog of mortgage applications. Services given in a realty deal aren't typically absolutely free. You may discover in your closing costs a line item called a "financing source charge." These are mortgage source fees billed by the MLO for processing as well as financing the lending.

Refusal to send the requested criminal background document check or a collection of fingerprints is grounds for disciplinary action. The disclosure is considered provided when deposited with USA Postal Service for fabulous delivery. " Serve as a mortgage loan provider" means to participate in business of making or servicing mortgage loan for settlement or gain, or in the expectation of payment or gain, either directly or indirectly, consisting of obtaining, handling, positioning, or discussing a mortgage.

For larger financings like mortgage, there is extra documentation, and also the process may take multiple days or weeks before the financing is fully available to the customer. You have to take 10 hrs of NMLS-approved proceeding education and learning, including two hrs of Oregon-specific proceeding education before revival each year. Nonetheless, you are not required to complete continuing education in the year that you completed your pre-licensure education and learning, including the follow this link four hrs of Oregon-specific pre-licensure education. We urge you to complete your proceeding education and learning needs prior to the revival duration in November each year.